With oil reaching a high of 107.26 in July of 2014 to a low of $29.42 in January, 2016, the last 2 years have been a roller coaster of emotions for Albertans and other oil-wealthy geographic regions. Now, we’re sitting at $48.64 as of October 3rd and if the trend line continues, there are reasons to be optimistic about the current state of the Alberta economy.

From the trend line, it seems we’re now far past the bottom of January 2016, and that a slow, but foreseeable recovery is on its way. As Alberta Venture put it: “Most predictions for the price of oil suggest $50 or $55 by the end of the year, and investors are preparing for another stretch of high energy prices. That puts a floor under the Albertan economy.”

Besides a trend line, why are experts so sure that oil prices are going to go up? For one, for the first time since 2008, OPEC has agreed to a modest cut in production, which had oil surging 6%, just based on this announcement. As of now, there hasn’t been an agreement on which country will cut what, but based on the surge, markets are optimistic, as are investors, and as should Albertans!

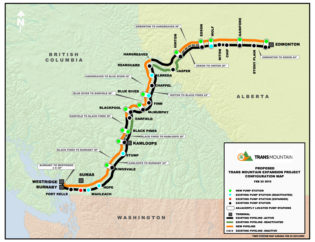

In local news, Alberta has recently approved three oil sand projects worth a potential $4 billion in investments, including Blackpool Resources Blacked Project, Surmount Energy’s Wildwood project, and Husky Energy’s Saleski project. All together, this would represent about 95,000 barrels of oil in daily production. These are the first projects to be approved under the new Climate Leadership Plan. If you’re interested in other major projects occurring in Alberta, check out this site, and you’ll notice that there are no shortage of projects on the horizon.

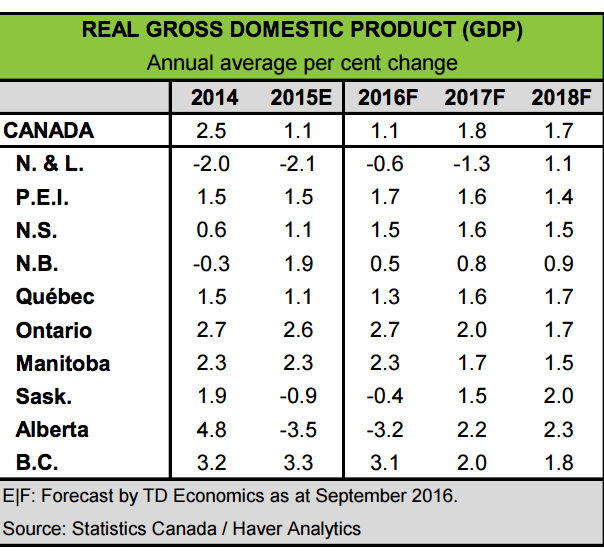

Finally, the majority of the optimism has originated from the TD economic forecast for September, which was recently released. The major takeaway? By 2017, Alberta will once again lead the country in real GDP growth, but will not lead it by quite as much as it did in the pre-2014 era, based on rising oil prices hitting $55 and above. The rebuild effort in Fort McMurray, oil production being restored, and the new oil sands projects coming online are the key drivers of our recovery. “The worst is in the rearview mirror” says the report.

Read the entire study to see their forecast for real GDP, unemployment, consumer price index, retail, housing starts, home sales, and average home price.

All in all, the experts agree, the worst is behind us. It’s time to start building Alberta again! Interested in getting a project off the ground? Contact us for a free consultation!